Reshoring and Direct Foreign Investments Drive Job Growth

Randy Wolken, President & CEO

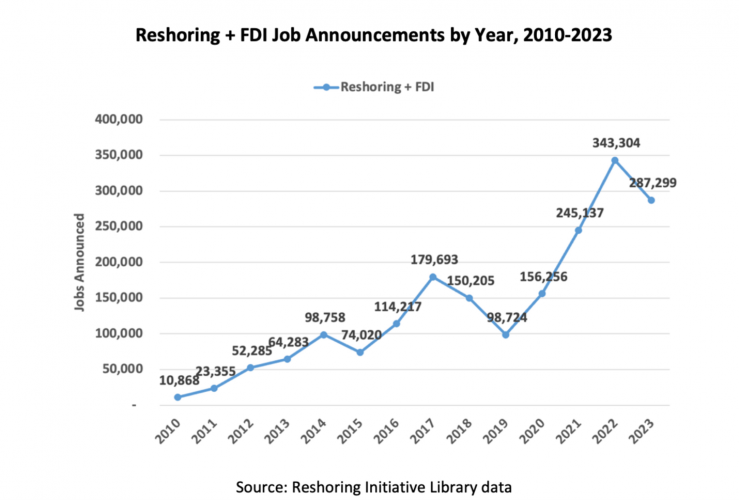

Reshoring and foreign direct investment (FDI) have increased job announcements in the last few years and continued to climb in 2023, where 287,000 jobs were added, making it the second-highest year on record. According to the Reshoring Initiative’s recently released Reshoring Initiative 2023 Annual Report, EV batteries, semiconductor chips, and solar energy are all essential goods supported by U.S. industrial policies, and accounted for 39% of the job announcements. The job increases are generally driven by efforts to shorten supply chains and bolster domestic resilience.

Geopolitical risk is the most significant driving force in reshoring and FDI trends. The ongoing conflict in Ukraine will likely continue redirecting FDI from Europe to the U.S. The concerns are over natural gas and electricity availability and pricing. European-origin announced jobs rose from 13% of the total in 2021 and 2022 to 34% in 2023, with a projected increase to 37% in 2024. The Hamas attack on October 7 will also influence FDI trends moving forward, although it was too late to impact the 2023 data set. Nearly all cases from Israel are FDI – its companies have long understood the value of having assets in the U.S. Finally, rising tension between the U.S. and China over Taiwan is a leading factor in industrial policy. Corporate strategists consider reshoring to be critical to their long-term planning. Twenty percent of the cases from 2010 to the present were related to reshoring, 72% due to FDI, and 8% were related to nearshoring.

The trends in reshoring and FDI indicate a movement towards strengthening U.S. manufacturing amid global uncertainties. Geopolitical developments continue to alter the landscape, driving investments that enhance supply chain resilience and U.S. job growth.